Facts About Acura Of Springfield Revealed

Facts About Acura Of Springfield Revealed

Blog Article

Getting The Acura Of Springfield To Work

Table of ContentsThe Ultimate Guide To Acura Of SpringfieldAcura Of Springfield Things To Know Before You BuyAcura Of Springfield Fundamentals ExplainedThe 3-Minute Rule for Acura Of Springfield

Getting a longer-term car loan will cause you to spend a lot more in passion, making the automobile more expensive to fund in the lengthy run. Lengthy repayment periods can also make it tougher to pursue various other economic goals or purchase a various auto if your scenarios transform especially if you still owe a lot of money on your loan.Doing your research, searching and getting preapproved can help you get the most effective deal on a brand-new automobile. However if you claim the wrong thing to the dealership while discussing or appear at the wrong time, you can swing goodbye to all of your difficult prep job. Even if a dealer asks in advance, do not mention your trade-in or your desire to obtain an automobile funding.

However if you negotiate the rate down to $22,000 first, and after that discuss your trade-in, you can wind up getting a price under the supplier's low end of $20,000. Many car salesmen have actually set sales objectives for completion of every month and quarter. Plan your browse through to the dealership close to these schedule times, and you might get a much better bargain or additional savings if they still require to reach their quota.

The 3-Minute Rule for Acura Of Springfield

After you have actually worked out the final car cost, ask the dealer concerning any type of deals or programs you receive or point out any kind of you located online to bring the rate down much more. Mentioning claiming the ideal things, do not inform the dealership what month-to-month repayment you're seeking. If you want the ideal offer, start negotiations by asking the dealer what the out-the-door price is.

Keep in mind those taxes and charges we stated you'll have to pay when getting a cars and truck? Suppliers can prolong lending settlement terms to hit your target regular monthly settlement while not lowering the out-the-door price, and you'll finish up paying even more rate of interest in the lengthy run.

Everything about Acura Of Springfield

It's a what-you-see-is-what-you-pay kind of rate. Just since you have actually discussed a bargain does not imply you're home-free.

If you decide to acquire an add-on, discuss that price, too. Lenders might require void insurance policy with brand-new automobiles, however you do not need to fund it through the dealership. Purchase it from your automobile insurance provider or store around for rates. Automobiles are a major acquisition, and you don't wish to be sorry for purchasing one prep work is key! Contrast vehicle prices around your location and always work out based upon the out-the-door price.

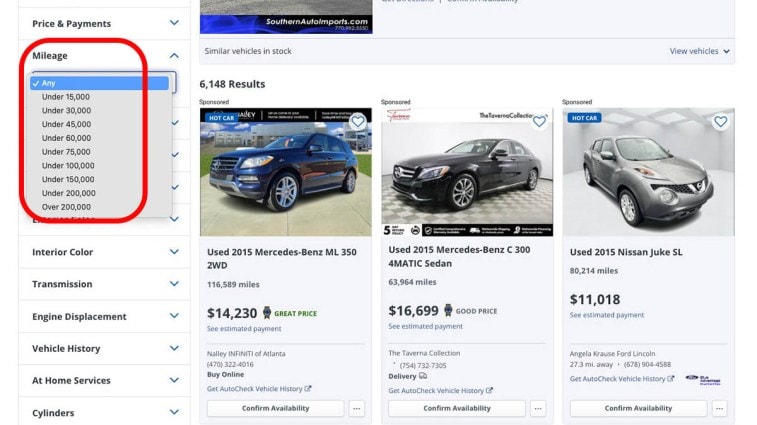

The wholesale rate is what suppliers pay for utilized cars at auction. A rate decrease is always a good sign official statement for secondhand car consumers.

You may locate on your own making some compromises in what you want versus what is offered, whether purchasing from a supplier or a personal seller. Loan providers are tightening their belts and their credit report demands. Rate of interest, typically greater for used auto loan than new vehicle loan, are progressively escalating. To put it simply, if you finance a used auto, the monthly settlements will be greater now than a year ago.

Acura Of Springfield for Dummies

It's influenced as much by the amount of time and money you can invest as anything else. However, here we will certainly outline the excellent, the poor, and the unsightly regarding both purchasing choices. You might be unwilling to acquire a pre-owned car from a personal vendor (often described as peer-to-peer) if you never bought by doing this before.

Furthermore, a personal vendor does not need to cover the overhead expenses a dealership produces. A supplier is really a middleman in the deal, developing the required revenue by blowing up the acquisition rate when selling the cars and truck. However, at the end of the day, the peer-to-peer offer will just be as good as the purchaser's negotiating abilities.

In theory, a personal vendor's original asking rate will certainly be lower than a car dealership's price for the reasons itemized over. By the time the buyer and vendor reach the negotiating stage, the private seller has actually invested a whole lot of time in offering you an automobile.

Report this page